How to Issue Refunds and Credit Memos

Updated

by Tyler MacDonald

Updated

by Tyler MacDonald

Refunds serve the purpose of representing actual money given back to a customer from payment. Credit Memo's allow you to generate a formal statement/document that records credit or adjustment that modifies that the balance of an invoice. You can only create credit memos for invoices.

How to Create a Refund

You can only create a refund when there is an overpayment or additional funds available from the customers payment. Here are the steps:

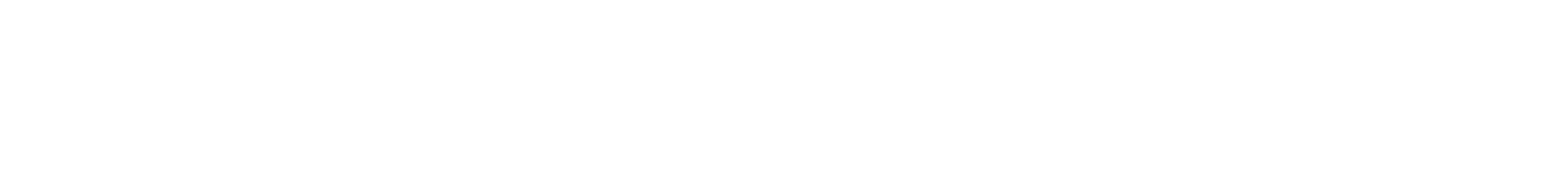

- Click on Transactions and select Payments.

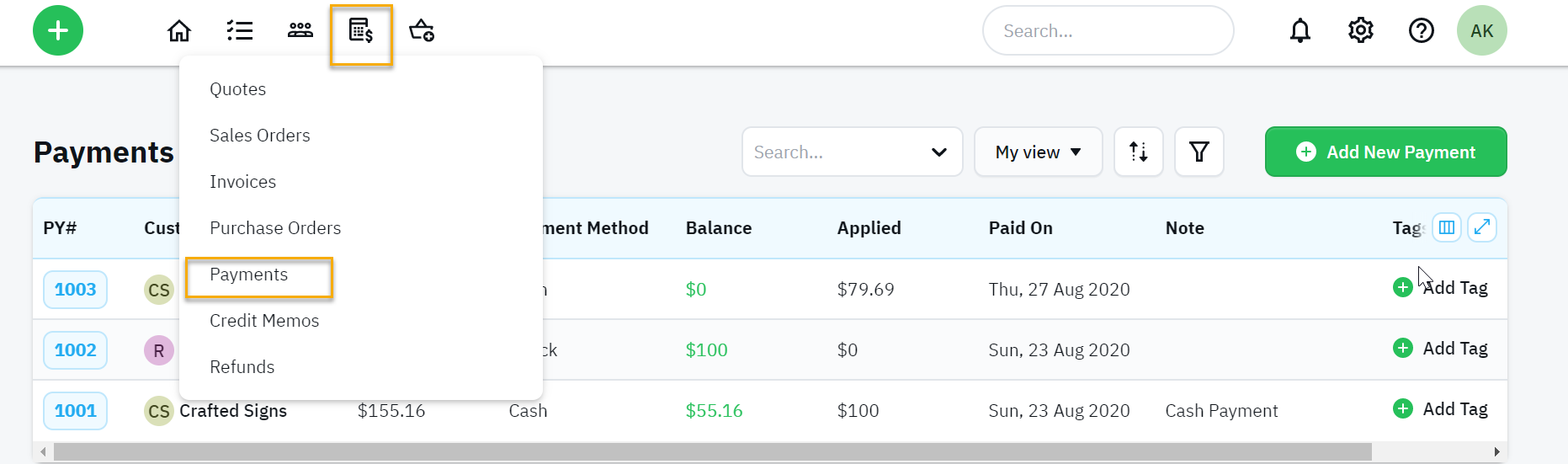

- Search for the appropriate payment and click on the payment number ( PY# )

- Make sure there is a balance on the payment to be able to create a refund.

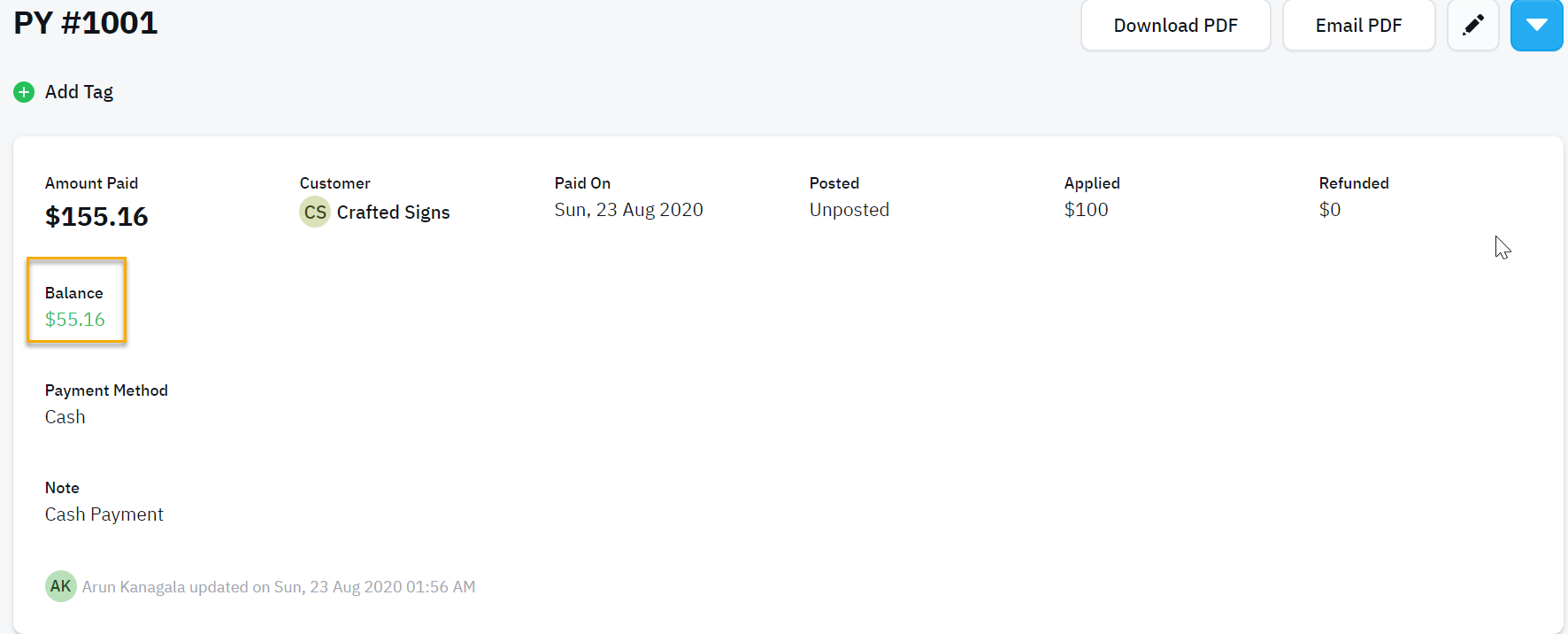

- Click on the Blue Action Button from the top right corner to select "Add refund"

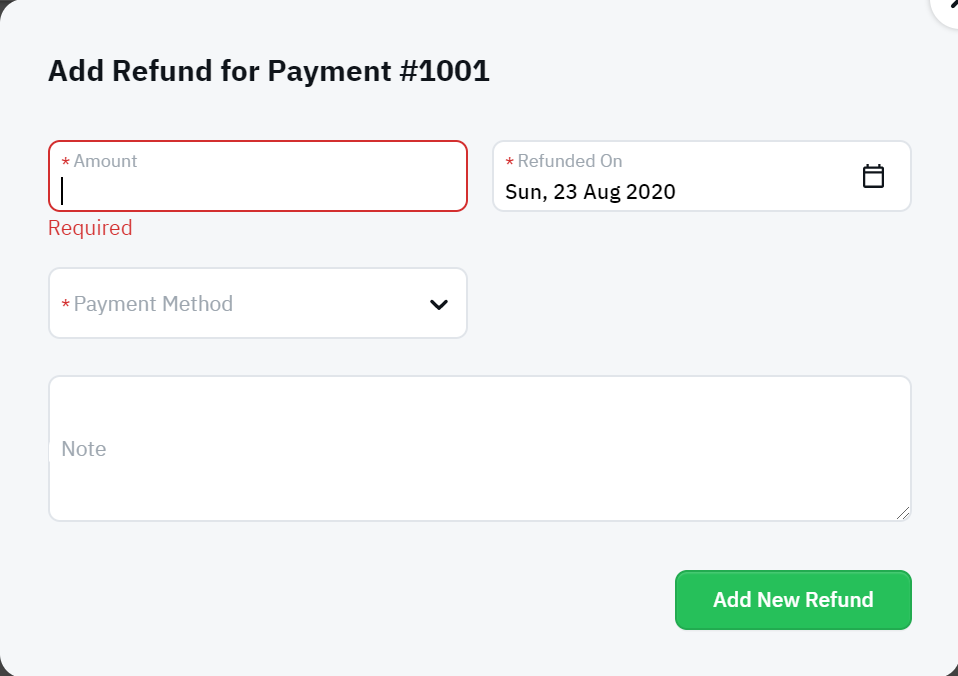

- Now enter the required details and click on - Add New Refund button.

How to Create a Credit Memo

You can ONLY create Credit Memo's from Invoices (not Sales Orders or Quotes). You'll usually issue a Credit Memo to raise or lower the invoice balance. You may also use a credit memo in the event the order was canceled or modified by you or the customer AFTER the Sales Order was converted to an Invoice (or after the customer was invoiced).

On the selected Invoice:

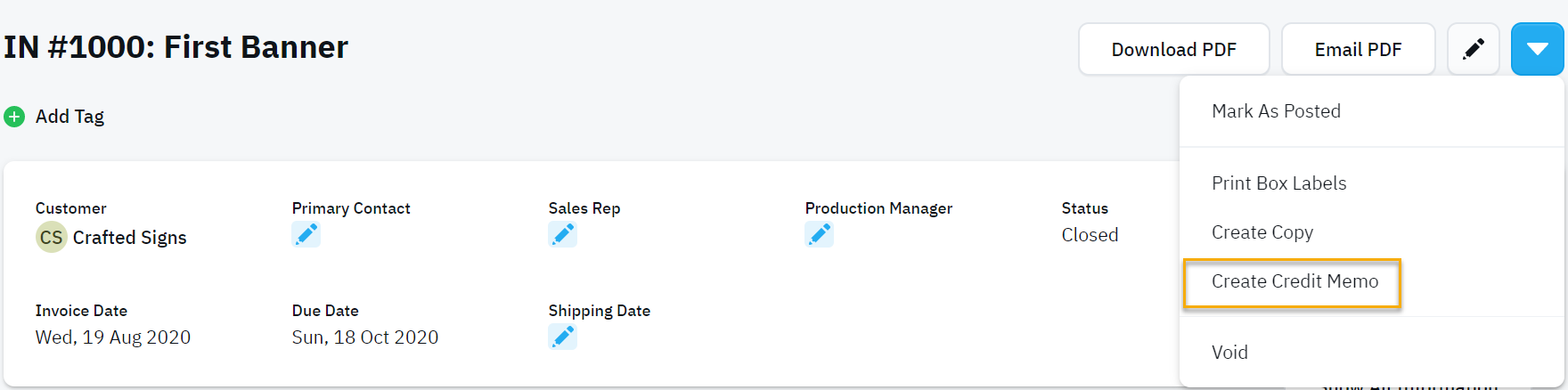

- Click on the Blue Actions button and select - Create Credit Memo.

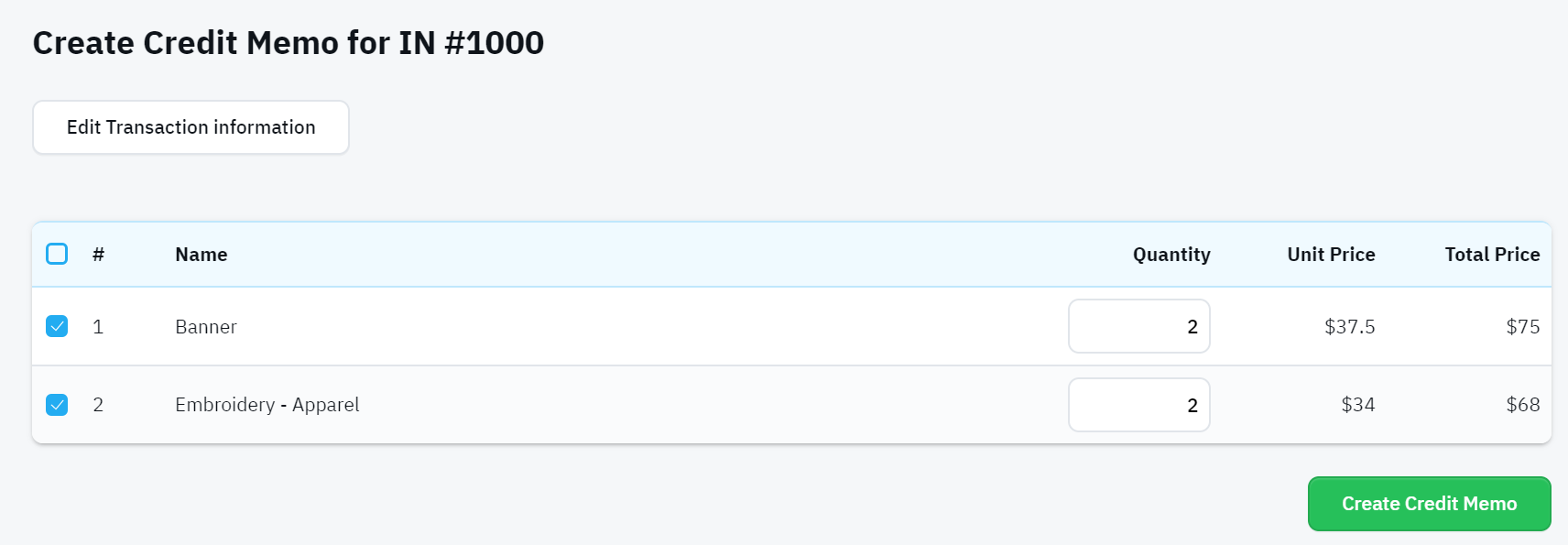

- Confirm what you will be crediting (select any line items you want on the CM)

- Click on Create Credit Memo.

You can modify these, you can check/look at the balance on the invoice to see how the CM is calculating/effecting the big picture.

Here are some situations to consider of when you might use Credit Memos:

- Your customer has already paid the full amount and you agree to give a credit to be used on future orders. In this scenario, create a credit memo and then record some sort of refund on the invoice.

- Customer made a partial payment, and an agreement was made to credit part of the order. In this scenario, create a credit memo for the credit amount. If done properly this credit memo will now show that the invoice balance owed is 0. This credit memo represents your company taking a hit/loss on the invoice, it also satisfies the remaining balance so it falls off the collections module.

- If the balance on an invoice shows negative this technically means you owe the customer, so you would issue a refund to fix this negative balance on the invoice.

- Some times customers make payments that are nominally short or over (+/- $1 depending on your currency). In these instances, credit memos allow you to correct/reconcile these discrepancies toward the invoice so that they are removed from your collection reports. They are a great way to get invoices to a zero balance.